Charitable Tax Deductions Tracked with ItsDeductible

You don’t want to forget any tax deductions. A big one that everyone remembers is charitable donations.

But how do you easily track all of those donations? You might have donated cash, stock, household items, or even driven your car to volunteer. All of these are prime tax deductions. And you don’t want to forget them.

That’s where ItsDeuctible can help.

Track tax deductions online

This is a FREE online service by TurboTax. It allows you to input all of your charitable donations throughout the year. And then it seamlessly imports into TurboTax at tax time. It easily tracks all different types of donations:

Cash – You can setup charities, and then input whenever you donate to them. Tell ItsDeductible how you made the payment, and it will keep track of the info for you. You can also setup recurring donations!

Stock – I don’t own any stock, so I haven’t tinkered with this feature yet. But I’m sure it works quite well, and it probably saves stock donation headaches.

Household items – This is an area where ItsDeductible really shines. When you donate used items to a charity, input them online. The program then tells you how much they’re worth! This ensures that you get the biggest tax deduction possible. Your used clothing is worth more than you think!

Mileage – Did you know that you can deduct miles driven to volunteer for a charity? ItsDeductible will keep track of these for you, and it automatically calculates the total amount you can deduct.

Input tax deductions all year

The key to really maximizing ItsDeductible is to input charitable donations as you make them. Don’t wait until April to try to remember every donation you made last year.

Since ItsDeductible is free and online, you have no excuse not to use it throughout the year. It will maximize your tax deductions and help save money at tax time. Isn’t that the name of the game?

Photo of hurricane Katrina donations by Schnittke

Get more legal tips

|

See also... |

Free Technical Support From MinuteFix

Do you need some technical support? You should check out MinuteFix.

This is a new tech support service, pioneered in part by Phil Gerbyshak. If you don’t know Phil, you definitely need to meet him. He’s a great guy, and I’m sure MinuteFix will be a great company!

If you need some technical support, just visit MinuteFix. They have certified technicians who will resolve your problem over the internet, or you don’t have to pay!

The cost is only $0.99 per minute. It’s 100% secure, and I’m sure you’ll be happy with the support.

By the way, it’s FREE until March 15!! That’s right, certified tech support for free. They’re confident that you’ll be completely satisfied and come back for future help.

For more info on MinuteFix, check out Phil’s post.

This is a great solution for all computer users. It can be incredibly useful for small business owners and solo lawyers. Don’t spend your time worrying about computer issues. Spend your time practicing law and satisfying clients!

Get more legal tips

|

See also... |

Virginia Lawyer – At Your Fingertips

Since I passed the Virginia bar exam and became a lawyer, life has been different.

People ask me legal questions. They bring problems to me. They look to me for help.

And I haven’t even marketed myself as a Virginia lawyer. I just blog, work my in-house counsel job, and ride my bicycle.

I’ve always been open to contact from anyone who needs help. And I want to make myself even more accessible.

Feel free to email me at aflusche@gmail.com. Or you can see other contact options on my contact page. You’ll also notice a new “chat badge” in the right sidebar, courtesy of Google. Ping me anytime!

If you ever have a Virginia legal issue, I am happy to be at your service. You may not live in Fredericksburg, but I can still help you. And if I can’t help, I’m rapidly developing a network of lawyer colleagues. Surely we can find someone to solve your issue.

I’m literally at your fingertips!

Your Virginia Lawyer,

Andrew Flusche

Get more legal tips

|

See also... |

Get Your Tax Refund In Record Time!

It’s February 23, and my 2007 federal tax refund is already in the bank. Where’s yours?

Tax refund options

I already wrote about tax deductions, so now it’s time to look at the best way to get your tax refund.

With almost every American filing a tax return by April 15, there are lots of services and software to help get the job done. But which one should you use?

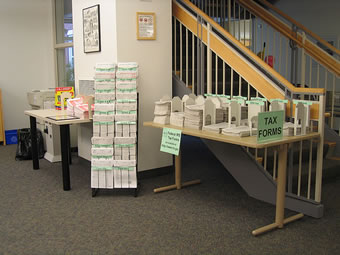

Paper forms – I’ve done this every year until now. Go to your local library or download the IRS tax forms from the internet. If you have a simple income situation, this is a solid free option to pursue.

Paid preparer – Businesses and high-income individuals will most likely pursue this option. Gather up your paperwork, go to your local accountant or tax preparer, and you’ll be done in a little while.

Tax software – There are lots of great options here, but my favorite is Turbo Tax. The basic version

is only $18.99, or you can get home and business

for $69.99.

The quickest refund

So how did I get my refund by February 23? Turbo Tax Online!

I filled out the online forms in my spare time over a few days. I e-filed my federal tax return on February 10. I selected the direct deposit refund option. And now I have my refund!

Just to be clear, it’s really easy to get a super quick federal tax refund:

- Fill out the Turbo Tax online forms

- Select direct deposit for your refund

- E-file your tax return with the IRS

I’m pretty pumped by these results. Darn cool! And I won’t be scrambling to the post office on April 15. Will you?

Photo by herzogbr

Get more legal tips

|

See also... |

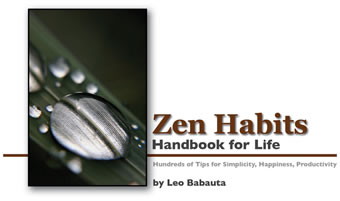

Ultimate Handbook for Life and Simplicity – Zen Habits

If you’re looking to simplify your life, Leo Babauta has the resource you need:

The Zen Habits Handbook for Life

This is a brand new e-book that Leo released today! I was privileged enough to receive a review copy, and it’s well worth the $6.95 he’s asking for it.

The Handbook for Life reorganizes a ton of the great tips from Zen Habits and presents them in a slick PDF format. This makes it easy to give as a gift, read on a plane, or just have a handy set of great tips on your computer.

There are three key sections to the book: simplicity, productivity, and happiness. Each section has 7-8 great articles like “Declutter Your Mind” and “Clear Out Your Inbox.” It’s incredibly well-written, and a quick read.

What are you waiting for? Snag a copy of The Zen Habits Handbook for Life and support Leo’s work. It’s only $6.95!

If you enjoy Leo’s writing, check out his great productivity e-book Zen to Done.

Get more legal tips

|

See also... |

Decision Time – Fix the Old or Buy New?

You’ve probably been faced with this important decision several times: Do you invest more money in your old thing or shell out the cash for a new one?

It doesn’t matter if we’re talking about your car, lawnmower, house, or computer. There’s a set of questions you run through. You make a decision based on similar factors, every time.

I’ve been facing one of these decisions all weekend. My bicycling hobby took me to the local bike shop. They kindly told me that it would take $320 to fix up my old bike. Maybe I should just buy a new one.

Factors to consider

1. Sentimental value – Obviously you’ll want to fix up old items that have sentimental value. You don’t want to just throw those out for a new one. I bought my bike off craigslist for $120. No sentimental value.

2. Age of item – A two-year-old car will get repaired, but a 20-year-old car might have lived out its useful life already. Unfortunately, it’s hard to know when some lives are done. My bike is over 20-years-old. Long enough for me.

3. Budget – How much money can you invest in this item? I try to look at all non-consumable items as investments, since I’ll hopefully be using them for years. But if your budget is small, you might have to keep hobbling along on the old lawnmower. My wife and I agreed that a portion of my blogging money would go to my bike fund!

4. Lifespan – How long do you expect to use this item? If you’re only going to need it for another 2 years, maybe fixing the old one is best. I hope to cycle for the rest of my life.

5. Self repair – When talking about repairs, there’s always an option of doing some things yourself. If you have some of the necessary tools (and know how to use them), go to town! But if you don’t know a wrench from a screwdriver, replacing your car’s fuel pump might be a disaster. I’m handy with tools, but I don’t have many specialized bike tools.

6. New features – Would the replacement item be identical to your old one? Or has technology improved and changed? The upgrades might make a new item well worth the expense. Bikes have definitely improved in the last few decades.

7. Availability of replacement – Perhaps this should’ve been first. If you can’t even buy a new one, you’re stuck repairing the old item. There’s a few bikes on the market today.

Anything else?

I’m sure I left out a few key factors. What do you think? Are there important things to consider that I neglected in this list?

Now I just have to pick which bike to buy….

Photo by bullish1974

Get more legal tips

|

See also... |

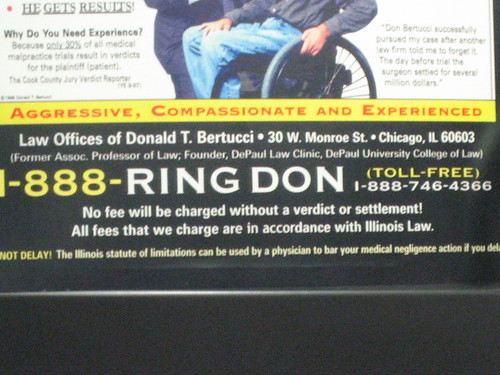

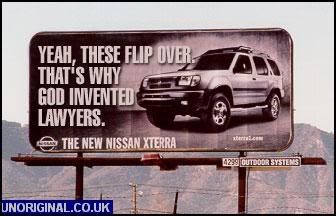

Crazy Attorney Advertising Pics and Videos

Where there’s an attorney, you’ll probably find crazy advertising. Florida has regulated it heavily, and most areas regularly deal with the same issues.

Attorneys can’t portray themselves offering assistance to aliens, and they can’t have a phone number like 1-800-PIT-BULL.

But lawyers still have some crazy ads and signs!!

Pictures

Quick legal help and a cup of coffee

Would you seriously consider hiring these guys?

Talk about specializing!

All the relief you need

Aggressive and compassionate

Videos

Pictures offsite

I’m trying to respect people’s copyright wishes. These pictures are pretty funny too, but you’ll have to click the links to view them.

Do you have any favorite lawyer ads?

Get more legal tips

|

See also... |

Screw Uncle Sam – Take Your Tax Deductions!

Uncle Sam tries to screw you all year long. But tax deductions are your chance to get him back! The more deductions you can claim, the more cash you get back. And who doesn’t like getting a fat tax refund?!

Here are some tax deductions that you might have overlooked. Don’t leave a single penny on the table!

1. Medical mileage – You surely didn’t forget to add up your medical expenses, but what about mileage to and from appointments? You can deduct $0.20 per mile for medical trips, and you can also include parking fees and tolls (PDF: 2007 Publication 502).

2. Educator expenses – Are you a teacher? You can deduct up to $250 of out-of-pocket expenses for books and supplies. And you don’t even have to itemize!! Just put the amount on line 23 of Form 1040 (Tax Topic 458).

3. Student loan interest – Most young adults have at least a little school debt. At least you can deduct the interest you pay on those loans. If you paid more than $600 in interest during the year, your lender should send you Form 1098-E, detailing your interest. This is another cool deduction that doesn’t require itemizing (Tax Topic 456).

4. Donations of goods – Did you give some old household items to Goodwill? Be sure to get a receipt, and you can deduct the value of those items. There’s even a cool online program (It’s Deductible) that helps track and value those donations (Tax Topic 506).

5. Jury pay – Nobody likes jury duty, but at least you can deduct the pay! If your employer paid your full salary while you served AND you turned over the jury duty pay to your employer, you’re eligible to deduct it. You can even claim this deduction on Form 1040A!

6. Health insurance premiums – Everyone can add health insurance premiums to their medical expenses deduction. And if you’re self-employed, you can deduct 100% of these premiums without itemizing! You have to love easy deductions like that!

7. Moving expenses – Did you move more than 50 miles for a full-time job? Deduct it! This includes self-employment, as long as you fulfill the “time” test (working enough hours each week) (PDF: Publication 521).

8. Higher-education – Did you pay college expenses this year? If you earned less than $65,000, you can deduct up to $4,000 of those expenses above-the-line (Publication 970).

9. Job hunting costs – If you’re looking for work in the same field in which you’re currently employed, deduct your expenses. There are some nuances here, but it’s definitely worth accounting for (Publication 529).

10. Tax prep fees – These are typically deductible in the year you pay them. For your 2007 tax return, you can deduct your 2006 tax preparation fees. This includes the cost of your software, accountant, and even e-filing.

What’s your favorite tax deduction?

Photo by andrewtr

Get more legal tips

|

See also... |

Get Connected with the Fredericksburg Area Bar Association

A professional is nothing without a network. Unless you’re a professional monk. Then I guess you can meditate all day in a secluded forest.

But the rest of us need to make connections. We need to know people, help them, and have friends to call on in times of need.

Lawyers especially need a network. How do you get clients without them knowing about you? Where will you turn for quick legal tips without knowing other lawyers? And how will you stay sane without friends?

Moving to Fredericksburg, Virginia

After law school in Charlottesville, my career brought our family to Fredericksburg, Virginia (technically Stafford, but Fredericksburg is next door). We knew no one here, except our new coworkers.

I set out to meet people. I’m a lawyer, so I wanted to join the local bar association. Too bad I couldn’t find it. Google didn’t turn up a website or a contact person. But I kept looking.

Finally I found a phone number for the Executive Director of the Fredericksburg Area Bar Association. I joined!

Meeting Fredericksburg lawyers

For only $95 per year, I’m a member of the local bar association. I go to our monthly meetings, and I’ve met a number of other local attorneys. This has been the best way to start establishing myself professionally.

I’ve only been a member since December, so I have been to just two meetings. My approach is to concentrate on remembering three or four names each meeting. I’ll get to know the whole crowd in due time.

Join your local group!

Where else will you find a room full of professionals in your field? Find the applicable local association of similar professionals and join up! It will probably be cheap and a great resource in your arsenal.

If there isn’t a group like this for your field or city, start one! Create a simple group on Meetup and start finding people who want to participate. There’s no excuse not to.

If you want to join the Fredericksburg Area Bar Association, email me and I’ll pass along the contact info.

What local professional group have you joined?

Photo of Fredericksburg City Hall by KHueg

Get more legal tips

|

See also... |

Your Copyright Fair Use Crash Course

Are you a blogger or podcaster? Or do you enjoy pro football games? Maybe you make videos for YouTube. You need to know about fair use. It might save your butt someday.

I am a Virginia-licensed attorney, but this article is only for educational purposes.

Copyright infringement defense

People who create original works obtain copyright in their creations. But copyright protection has limits.

If you are accused of violating someone’s copyright, fair use is a potential defense. You have to prove that your actions constituted fair use. How do you prove it?

Rely on the First Amendment

The First Amendment to the U.S. Constitutions intersects with copyright protection at fair use. This defense claims that you’re just exercising your free speech in response to someone’s copyrighted work.

Because of the free speech angle, most fair use cases center on comment & criticism or parody. If you’re just pirating software or stealing someone’s book, you’re out of luck. But if you’re adding creativity and doing more with a work, it might be fair use.

To help your analysis, the Copyright Act sets forth four factors to analyze. Here are some key questions from those factors.

Are you transforming the work?

If you take a copyrighted work and do something original with it, you can try to claim fair use. You need to transform the work into your own thing that has value.

If you take a copyrighted work and do something original with it, you can try to claim fair use. You need to transform the work into your own thing that has value.

This is where parodies come into the picture, like Weird Al, or the innumerable YouTube clips. They’re generally safe from copyright claims because they’re using a work to make fun of it. Even our stodgy courts value humor!

Do something new and unique.

Is the original fact or fiction?

Copyright doesn’t protect facts. It only protects original creative works. So courts are more likely to find fair use when the original work is non-fiction.

For example, TIME magazine claimed copyright in the Zapruder film of JFK’s assassination. But the copyright fell through when a history book printed stills from the film. The public interest is best served by reprinting and distributing facts.

Be careful with fictional works.

How much are you using?

Fair use won’t let you reproduce a work in its entirety. Always use less than the whole. But how much you can use is anyone’s guess.

Image search engines (like Google Images) can create thumbnails of the images for its index. But you can’t reproduce the “heart” of the work.

Use as little as possible.

What’s the market like?

Copyright helps authors exploit their work for value. If your use harms the market for the original work, you might be in trouble.

This was a key concern in the famous Betamax case (Sony v. Universal). But the entertainment industry couldn’t prove that VCRs were harming their market of viewers.

Don’t harm the market.

Companies to avoid

Everyone protects their property. Some authors are less concerned about copyright, and some are much more concerned. Watch out for these copyright lions:

Everyone protects their property. Some authors are less concerned about copyright, and some are much more concerned. Watch out for these copyright lions:

- NFL – The National Football League is known as a copyright jerk. It has bullied churches who show the Super Bowl on big screens. It tried to trademark “the Big Game.” And they claim that fair use stops at 45-seconds.

- Disney – They don’t want to lose control over Mickey Mouse, so Disney has fought to extend copyright protection. Where did the public domain go? But you can learn about copyright at Disney’s expense, thanks to this awesome video: A Fair(y) Use Tale.

- RIAA – The Recording guys actually think ripping CDs to your iPod isn’t fair use. And we all know they vigilantly protect their music!

More resources

Fair Use, Free Use, and Use by Permission: How to Handle Copyrights in All Media

Copyright Handbook: What Every Writer Needs to Know

Clearance and Copyright: Everything the Independent Filmmaker Needs to Know

Stanford Copyright & Fair Use Center – Check out the fair use page.

Electronic Frontier Foundation – Tons of information and updates on digital intellectual property issues.

Indiana University – Here’s a handy copyright management center.

Photos by PugnoM, Joe Gratz, penguins never jump!

Get more legal tips

|

See also... |